Azərbaycanın reytinqləri təsdiqləndi - Mənfi və müsbət ssenarilər

7 iyun 2024-cü il tarixində "S&P Global Ratings" Azərbaycanın uzunmüddətli və qısamüddətli xarici və yerli valyutada suveren kredit reytinqlərini “BB+/B” səviyyəsində təsdiqləyib. Proqnoz "Stabil"dir.

Marja.az "S&P Global Ratings"ın yaydığı məlumata istinadən xəbər verir ki, "Stabil" proqnoz neft hasilatının proqnozlaşdırılan ortamüddətli azalmasına baxmayaraq, Azərbaycanın əhəmiyyətli fiskal və xarici buferlərinin iqtisadiyyatı hər hansı şoklardan qorumağa kömək edəcəyinə dair gözləntiləri əks etdirir.

Mənfi ssenari

"S&P Global Ratings" qeyd edib: Azərbaycanın fiskal balansı ortamüddətli perspektivdə gözlədiyimizdən daha zəif olarsa, biz reytinqləri aşağı sala bilərik. Məsələn, köhnə neft yataqlarının tükənməsi ölkənin neft hasilatının gözlədiyimizdən daha sürətlə azalması ilə nəticələnə bilər. Azalan karbohidrogen gəlirləri Azərbaycanın daha geniş iqtisadi göstəricilərinə təsir göstərə bilər.

Biz Ermənistanla hərbi münaqişənin yenidən başlaması ssenarisində də reytinqləri aşağı sala bilərik.

Müsbət ssenari

Azərbaycan indiki proqnozumuzla müqayisədə əhəmiyyətli əlavə fiskal buferlər (valyuta ehtiyatları - red) toplasa, regional geosiyasi risklər azalsa, biz reytinqləri qaldıra bilərdik.

Əsaslandırma

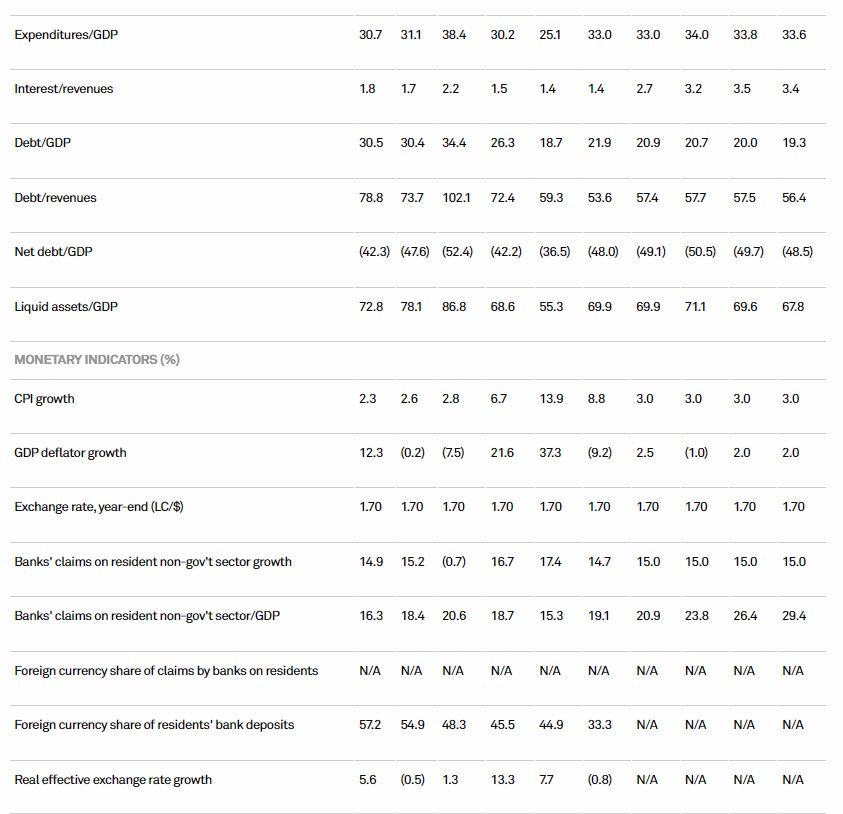

Azərbaycanın güclü fiskal və xarici səhm mövqeləri suveren reytinqlərini dəstəkləyir. Hökumət, suveren fond Azərbaycan Respublikası Dövlət Neft Fondunda (ARDNF) əhəmiyyətli likvid aktivlər toplayıb. Biz hökumətin 2027-ci ilə qədər ÜDM-in təxminən 70%-ni təşkil edən likvid aktivlərə çıxış əldə edəcəyini və ümumi dövlət borcunun ÜDM-in 20%-i ətrafında sabitləşəcəyini proqnozlaşdırırıq. Biz gözləyirik ki, Azərbaycanın qarşıdakı üç il ərzində ikiqat fiskal və cari əməliyyatlar hesabı profisiti davam edəcək ki, bu da bizim 2024-cü ilin qalan hissəsi üçün orta hesabla 85 dollar/barel neft qiymətləri və bundan sonra 80 dollar/barel proqnozlaşdırdığımız neft qiymətlərinə əsaslanır.

XXX

Azerbaijan Ratings Affirmed At 'BB+/B'; Outlook Stable

Overview

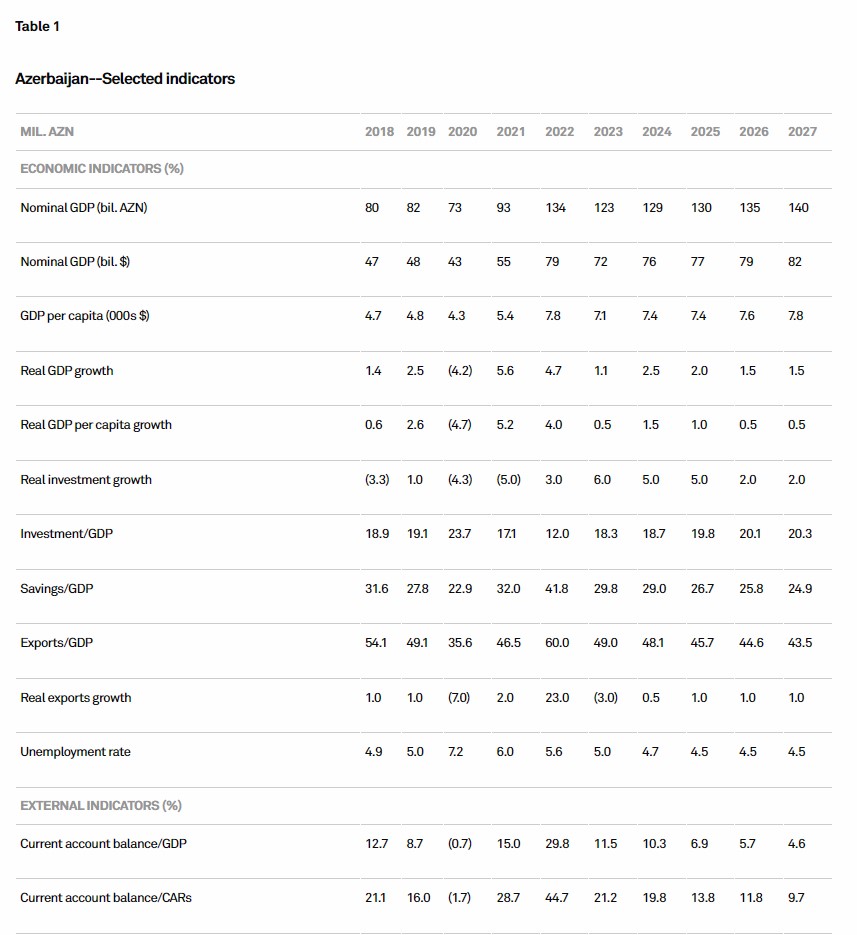

We expect Azerbaijan to run twin fiscal and current account surpluses over 2024-2027, reflecting currently favorable prices for hydrocarbons, which constitute 80% of its exports, although oil production remains on a long-term declining trend with new gas exports unlikely to fully offset the impact.

Azerbaijan has accumulated significant liquid fiscal assets within the State Oil Fund of Azerbaijan (SOFAZ, the sovereign wealth fund) which we estimate at 70% of GDP at end-2023 and which helps cushion near-term risks.

Peace talks between Armenia and Azerbaijan continue, against a backdrop of shifting regional and geopolitical tides.

We affirmed our 'BB+/B' ratings on Azerbaijan and maintained the stable outlook.

Rating Action

On June 7, 2024, S&P Global Ratings affirmed its 'BB+/B' long- and short-term foreign and local currency sovereign credit ratings on Azerbaijan. The outlook is stable.

Outlook

The stable outlook reflects our expectation that, despite a projected medium-term decline in oil production, Azerbaijan's significant fiscal and external buffers will help to shield the economy against any renewed terms-of-trade shocks.

Downside scenario

We could lower the ratings if Azerbaijan's fiscal balances prove weaker than we expect over the medium term. This could happen, for example, because aging oil fields result in oil production declining faster than we expect. Reduced hydrocarbon earnings could also weigh on Azerbaijan's broader economic performance, compared with that of peers.

We could also lower the ratings in a scenario of renewed military conflict with Armenia.

Upside scenario

We could raise the ratings if regional geopolitical risks subsided while Azerbaijan accumulated significant additional fiscal buffers, compared with our current forecast.

Rationale

Azerbaijan's strong fiscal and external stock positions support the sovereign ratings. The government has accumulated substantial liquid assets within the sovereign wealth fund SOFAZ. We forecast that the government will have access to liquid assets of nearly 70% of GDP through 2027 and that gross general government debt will stabilize around 20% of GDP. We expect Azerbaijan will continue to run twin fiscal and current account surpluses over the next three years, which is based on our projected oil prices of $85 per barrel (/bbl) on average for the remainder of 2024 and $80/bbl thereafter (see "S&P Global Ratings Revises Its WTI And Brent Price Assumptions For 2025 And Beyond On Anticipated Oversupply," published March 11, 2024, on RatingsDirect).

At the same time, Azerbaijan's economy remains concentrated in the oil and gas sector, which accounts for close to 50% of GDP, and 80% of goods and services exports. Consequently, Azerbaijan remains vulnerable to any potential adverse changes in hydrocarbon prices. In 2015, for example, on the back of lower oil prices, Azerbaijan's government deficit deteriorated by over 7 percentage points (ppts) of GDP, the current account weakened by 14 ppts of GDP, net reserves declined by over half, households and companies shifted savings into dollars, and the exchange rate was devalued. In our view, while Azerbaijan's buffers are sizable, they cannot fully protect its concentrated economy from all the consequences of a drop in key export prices, especially if such a drop proved to be sustained, while a structural decline in oil production further constrains the size of these protective buffers.

Our ratings on Azerbaijan also remain constrained by weak institutional effectiveness and still limited monetary policy flexibility.

Institutional and economic profile: Limited diversification away from hydrocarbons

Azerbaijan's oil output remains on a long-term declining trend as oil fields age. Gas production is approaching a plateau after production ramp-ups in recent years and will likely increase only marginally from 2023 levels over the medium term.

We forecast Azerbaijan's growth at just below 2% on average over 2024-2027, reflecting stagnating hydrocarbon output and growth in the non-oil sector of 3%-4% annually.

Azerbaijan's institutional environment remains weak and political power is centralized around the presidential administration.

Azerbaijan remains in talks with Armenia on a comprehensive peace deal, amid a shifting geopolitical situation across the region. Following a one-day military offensive in September 2023, Azerbaijan gained control over the parts of the Karabakh territory it had not seized in 2020. This region has been at the crux of a dispute between Azerbaijan and Armenia for decades, triggering a war in the 1990s and in September-November 2020, when Azerbaijan captured significant parts of Karabakh and surrounding territories. Following the brief September 2023 escalation, the local Armenian authorities in Karabakh surrendered and a ceasefire promptly ensued, followed by an agreement to transfer the region to full Azerbaijani control. The development led to a mass and swift departure of ethnic Armenians from Karabakh to Armenia.

One of the points of contention in signing the peace treaty remains the process of border demarcation. Armenia's government earlier agreed to Azerbaijan's demands to hand over several exclave villages inside its borders. This has led to public protests against this decision in Armenia with protesters demanding the resignation of Armenian Prime Minister Nikol Pashinyan. Nevertheless, the two sides have stepped up bilateral negotiations, which have been held in several capitals in Europe and the Commonwealth of Independent States. Official statements suggest that it remains possible to sign the agreement before the COP-29 conference in Baku scheduled for November 2024.

Strained relations with Armenia have recently also had broader foreign policy repercussions. In particular, Azerbaijan's relations with France have deteriorated over what Azerbaijan considers France's more pro-Armenia position. In February 2024 Azerbaijan's parliament adopted a statement calling for severing ties with France and the expulsion of French companies. We note that no concrete actions have so far materialized from this, but risks remain given that several French companies operate in Azerbaijan, including TotalEnergies, which is currently developing the Absheron gas field project. France subsequently recalled its ambassador to Azerbaijan for consultations, but the ambassador recently returned to Baku.

In February 2024 Azerbaijan held a snap presidential election, which incumbent President Aliyev won with more than 92% of the vote. We don't expect any significant changes in policy in the election's aftermath. Political power in Azerbaijan remains concentrated with the president and his administration, and there are limited checks and balances. The current president succeeded his father Heydar Aliyev in 2003 and has remained in power since.

There are material gaps in economic data published by Azerbaijan's authorities. For instance, there are no volume national income accounts available broken down by expenditure. Also lacking is the international investment position data for the overall economy.

Azerbaijan's economic growth has exhibited a stronger pattern throughout the first four months of 2024 with real GDP expanding by 4.3% year on year, predominantly driven by the non-oil sector, while the oil sector contracted. This follows a muted full-year growth performance of 1.1% in 2023. Over January-April 2024 the non-oil sector grew by almost 8% with an expansion of cargo and passenger transportation, information and communication services, and retail trade turnover. We also note the strong growth in the construction sector, which reflects the investments the authorities are undertaking in the captured Karabakh region. If it were not for the Karabakh-related investments, we think that implied growth in the non-oil sector would be weaker.

We expect the non-oil sector to grow by 3%-4% annually over the medium term. Structural reforms and sustained economic diversification efforts have been limited, in our view, which will be an obstacle for faster growth.

In parallel, we expect the output in the hydrocarbon sector (which accounts for around 50% of Azerbaijan's nominal GDP) will broadly stagnate over 2024-2027. This forecast is based on the following expectations:

Oil output remaining at an average 0.65 million bbl per day (mbpd) through 2027. Production has been on a steady declining trend in recent years as key oil fields, such as Azeri-Chirag-Gunashli, continue to age, falling to 0.65 mbpd in 2023 from 0.79 mbpd in 2019. As a result, Azerbaijan has been continuously producing below the quotas allocated to it by OPEC+. We expect some stabilization in the next few years as continued decline in some fields will be offset by small capacity additions at others. Longer term, however, production will likely continue falling.

Gas production stabilizing at close to 35 billion-36 billion cubic meters (bcm) annually. Azerbaijan's gas output has grown substantially since 2018, when production commenced at the key Shah Deniz II (SDII) gas field (production of roughly 16 bcm at plateau), operated by BP. The two related pipelines--the Trans-Anatolian Natural Gas Pipeline and the Trans-Adriatic Pipeline--carrying gas to Turkiye and Europe, respectively, became operational in 2019 and 2020. In July 2023 production also started at the smaller Absheron gas and condensate field (approximately 1.5 bcm), operated jointly by TotalEnergies and State Oil Company of the Republic of Azerbaijan (SOCAR). Given that the vast majority of production ramp-up has already happened, we estimate that Azerbaijan is approaching peak gas production, which will be maintained for several years.

There are several projects that could further expand gas production over the longer term, beyond our forecast horizon. These include:

The next phase of the Absheron field (expanding production from 1.5 bcm a year to 5.0 bcm); and

Azeri-Chirag-Guneshli (ACG) deep gas development, exploring the possibility of extracting gas from underneath the currently producing ACG oilfield (we understand that the scale of production is not clear so far).

The above-mentioned projects are in the planning stage and will take several years to complete, once and if the decisions to proceed are taken. We also note that the key export South Caucasus Pipeline is operating at near full capacity, so any additional net gas exports, including to Europe, will require further expansion of the pipeline infrastructure. Such an expansion would, in turn, necessitate reaching agreements between Azerbaijan and key European buyers of its gas about long-term volumes of supplies and its pricing.

Flexibility and performance profile: Sizable fiscal and external net asset positions

We forecast that Azerbaijan will retain twin fiscal and current account surpluses averaging 1.7% of GDP and 7% of GDP over 2024-2027 respectively.

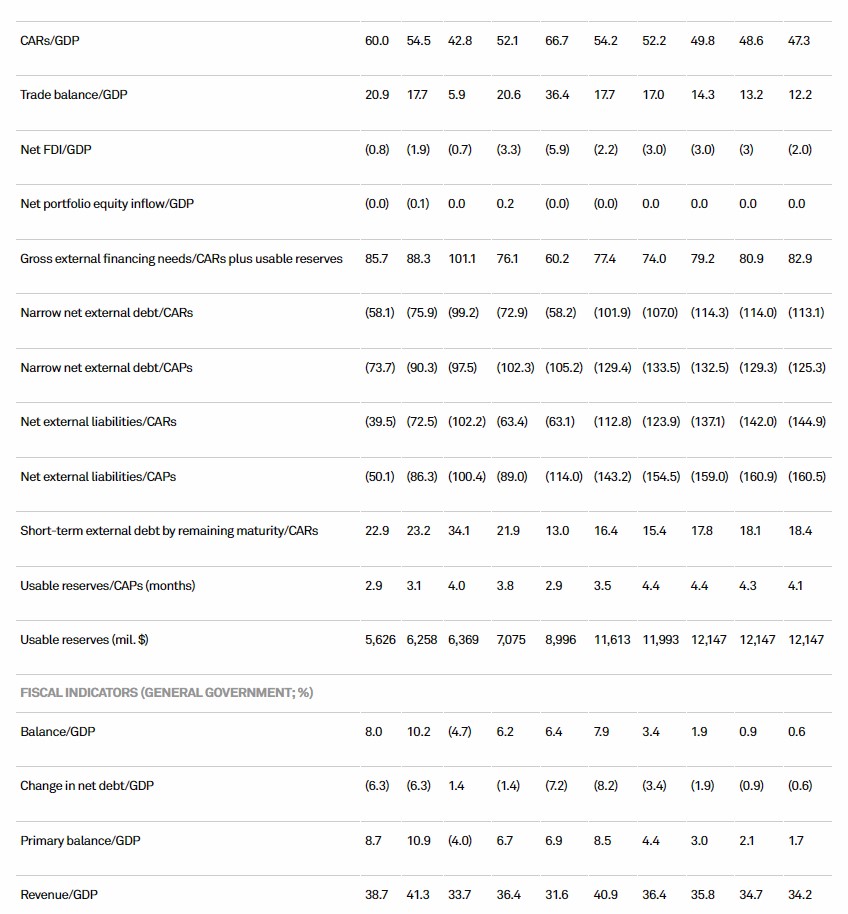

Azerbaijan will also retain an average general government net asset position of around 50% of GDP through 2027.

Monetary policy effectiveness remains limited, constrained by the central bank's limited operational independence, heavy intervention in the foreign exchange market, and underdeveloped local currency capital markets.

We consider that Azerbaijan's strong external stock position will remain a core rating strength, reinforced by the substantial foreign assets accumulated at SOFAZ. We estimate that external liquid assets will surpass external debt through 2027 and the net international investment position will average 68% of GDP in 2024-2027. Although Azerbaijan remains vulnerable to potential terms-of-trade volatility, we consider that its large net external asset position will serve as a buffer that could mitigate the potential adverse effects of economic cycles on domestic economic development. Based on our oil price and production forecasts, we expect that Azerbaijan's current account surplus will average 7% of GDP over 2024-2027, following a record 30% of GDP current account surplus in 2022, the highest level in over a decade.

We forecast general government fiscal surpluses to average 1.7% of GDP over 2024-2027, gradually declining toward balance as expenditure increases (including on additional investments in Karabakh), while oil production remains flat. The authorities have made provision for a recurrent deficit in the consolidated budget in the next several years, but this is based on an average oil price of $60/bbl, versus our forecast price of $80/bbl. Indeed, given the actual average oil price over 2021-2023 exceeded the budgeted one, Azerbaijan recorded a 7% of GDP average general government surplus against the official deficit projections. We forecast a general government surplus of 3.4% of GDP in 2024.

Despite a rapid increase in natural gas production volumes in recent years, we consider that the related fiscal receipts for the government will remain markedly lower than from oil. For instance, even with the much higher recent prices for gas, the proceeds from Shah Deniz gas sales transferred to SOFAZ over 2023 amounted to about $1.3 billion compared with almost $7 billion for oil sales from the ACG field.

Azerbaijan's net fiscal asset position remains strong, mirroring its external position and supporting the sovereign ratings. We expect that the net general government asset position will remain about 50% of GDP through 2027. In calculating net general government debt, we include our estimate of SOFAZ's external liquid assets. We exclude less-liquid exposures equivalent to about 14% of 2023 GDP--including the fund's domestic investments and certain equity exposures abroad--because we consider that they could not be liquidated quickly when needed. Azerbaijan is far more transparent than many of its peers (such as those in the Gulf Cooperation Council) about the composition of its assets and size of the sovereign wealth fund. For example, SOFAZ publishes detailed audited annual reports with granular information on the categories of investments it holds.

The government owns a majority stake in International Bank of Azerbaijan (IBA), and in 2017 the government restructured the bank and assumed some of its debt. The government has also transferred IBA's nonperforming loans--with a book value of about Azerbaijani manat (AZN) 10 billion--to AqrarKredit, a state-owned nonbanking credit organization funded by the Central Bank of Azerbaijan (CBAR). There is a government guarantee on the loans provided to AqrarKredit by CBAR. We therefore include AqrarKredit's sovereign-guaranteed loans of AZN9.5 billion in our general government debt calculations.

Excluding the guaranteed debt of AqrarKredit, Azerbaijan's direct gross government debt is low, totaling 14% of GDP at the end of 2023. Of this, around a third is domestic debt denominated in local currency, while the rest represents external foreign-currency denominated debt. In turn, around 65% of external debt pertains to bilateral and multilateral creditors, while 35% was in the form of Eurobonds as of end-2023.

We forecast that Azerbaijan will retain the manat's de facto peg to the U.S. dollar at AZN1.7 to $1.0, supported by the authorities' regular interventions in the foreign-currency market. Nevertheless, should hydrocarbon prices drop sharply and remain low for a prolonged period, we assume the authorities might consider adjusting the exchange rate to protect CBAR foreign currency reserves from a significant decline, like the one that happened in 2015.

Despite the improved predictability brought about by fixing the manat exchange rate to the dollar, it deprives CBAR of the ability to conduct an independent monetary policy, which, in our view, is also curtailed by the bank's still-limited operational independence. Domestic deposit dollarization has notably declined in recent years, to 37% as of April 2024 from 55% before the pandemic. We consider that a significantly higher average interest rate on national currency deposits of 8.4%, compared with 2.5% for foreign currency deposits, against the background of the stable exchange rate, and favorable, above-budgeted oil prices have improved the attractiveness of savings in manat. That said, we consider that in a scenario of downward pressure building on the manat exchange rate, domestic residents could quickly re-dollarize to hedge their inflation and foreign exchange risks.

In our view, Azerbaijan's banking industry continues to show signs of recovery from a protracted correction. After several years of stagnation, lending activity has rebounded since 2020 and we expect that the gradual easing of monetary conditions should support lending growth over 2024-2025. We think nonperforming loans (NPLs) could moderately increase to about 4.0% over the next two years, compared with 2.6% officially reported by the central bank at year-end 2023, as loan portfolios gradually season. For more details on Azerbaijan's banking sector see "Banking Industry Country Risk Assessment: Azerbaijan," published Feb. 20, 2024.

Key Statistics

Müştərilərin xəbərləri

Bakıda Dubayın inşaat şirkətlərinin iştirakı ilə satış tədbiri keçiriləcək – 3 gün Ramazana özəl təkliflər

SON XƏBƏRLƏR

- 1 ay sonra

-

1 ay sonra

“Coca-Cola” tələbələr üçün “One Idea” innovasiya müsabiqəsinə start verdi

- 18 saat sonra

-

-

4 saat əvvəl

Hökumətdə iclas keçirilib, sahibkarların qaldırdığı məsələlər müzakirə olunub, qərarlar qəbul olunub

- 5 saat əvvəl

- 5 saat əvvəl

-

5 saat əvvəl

Təsisçiləri şirkətə illik 10 faizlə 142 milyon manat borc veriblər

-

5 saat əvvəl

Dağıstandakı “Ozon” logistika mərkəzi “Şimal-Cənub” dəhlizinin bir hissəsi olacaq

- 5 saat əvvəl

-

6 saat əvvəl

Avropa Mərkəzi Bankı üç il ardıcıl zərər açıqlayıb, sədri isə illik 702 min dollar maaş alıb

-

6 saat əvvəl

"Saloglu" mağazalarında bütün mebellər fabrik qiymətinə endirilib

- 6 saat əvvəl

Son Xəbərlər

Azərbaycanda Vakansiyalar - Azvak.az

Kriptovalyuta ticarəti kursu

ABB-dən 100 milyon manatlıq istiqraz

Avropa Mərkəzi Bankı üç il ardıcıl zərər açıqlayıb, sədri isə illik 702 min dollar maaş alıb

"Saloglu" mağazalarında bütün mebellər fabrik qiymətinə endirilib

Bakıda Dubayın inşaat şirkətlərinin iştirakı ilə satış tədbiri keçiriləcək – 3 gün Ramazana özəl təkliflər

Dolların sabah üçün rəsmi məzənnəsi müəyyən olunub

"Uzbekneftegaz" və SOCAR Buxara neft emalı zavodunun modernləşdirilməsini müzakirə edib

Dünya İqtisadi Forumunun prezidenti istefa verib

Jeep istehsalçısı böyük məbləğdə zərər açıqladı

Yanvarda bank sektorunda çalışanların sayı 154 nəfər azalıb